All projects

Driving growth: From 0 to +1,000,000 users

Industry

Fintech

Company

SoyYo

Business model

B2C

Challenge

As a startup, in the beginning we had few active users since B2B client integrations took a long time to launch. This made it difficult to attract new partner companies, so we needed a strategy to grow our user base independently of B2B partnerships. The goal was to increase user adoption by delivering direct value to users.

How this was impacting the business:

Slowed Growth and Revenue: Lack of attraction from partner companies (clients) due to insufficient user base on the app, was delaying new deals and revenue streams from B2B partnerships.

Network Effect Limitation: In two-sided business models (like B2B2C platforms), user growth and B2B partner growth reinforce each other. Having too few users broke that loop: partners didn’t join because there were no users, and users didn’t join because there were no partners.

Outcomes and impact

Reached 1M+ active users on the platform.

Achieved 2K+ app downloads in a single weekend after launch.

Gain 10+ active B2B partner companies.

My role

I designed a new feature from the ground up, leading the process from the initial concept to implementation and subsequent iterations. I conducted discovery research with users and facilitated co-creation sessions with multidisciplinary teams to shape the solution. I designed the flow to integrate a low-effort MVP solution into the app, focusing on quick implementation and user validation. After validating the MVP, I designed the final product by structuring the information architecture, defining the content, and creating the high-fidelity visual design to ensure a cohesive and engaging user experience.

Solution

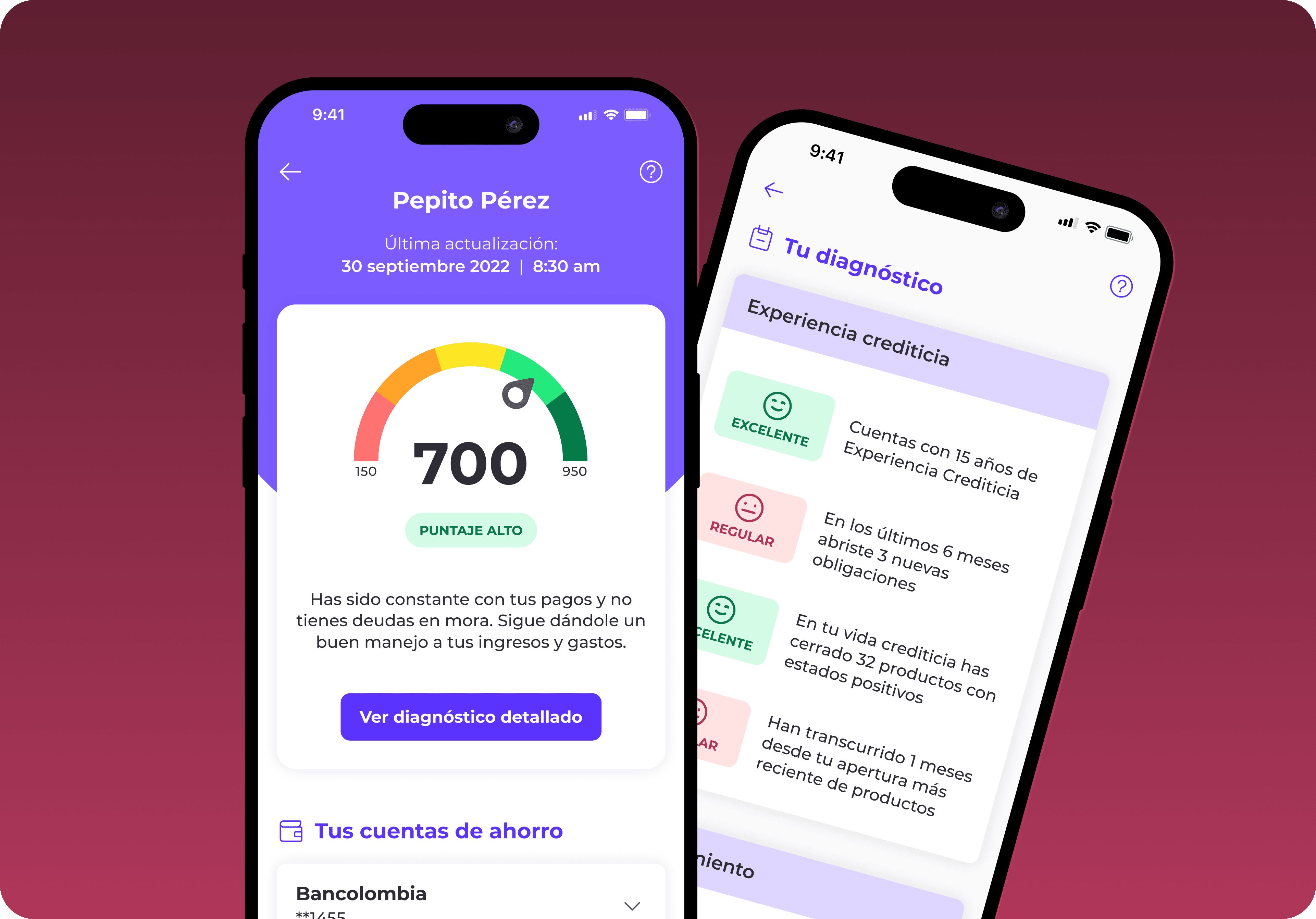

A service that allows users to access their credit history and gain control over their financial record. It provides detailed information on open accounts, overdue payments, and other active financial products, helping users stay informed about their credit profile, identify inconsistencies, and better manage their credit history. Additionally, it offers actionable, verified advice from credit risk agencies to improve and maintain a healthy credit score.

All projects